The impact of Reference Rate reform – Transition from LIBOR to SOFR

For commercial borrowers, the most significant change in several decades will impact loan pricing over the next several years. Already underway is a global transition away from referencing the London Interbank Offered Rate, or LIBOR, and toward new reference rates that are more reliable. The use of LIBOR as an international benchmark will likely cease in late 2021. In 2014, as LIBOR’s future became uncertain, the Fed embarked on a plan to ensure such a transition runs smoothly. It has since outlined a Paced Transition Plan timeline in detail and selected the Secured Overnight Financing Rate (SOFR) as the rate that represents best practice for use in US dollar financial contracts, while providing useful guidelines for the implementation of SOFR along the way.

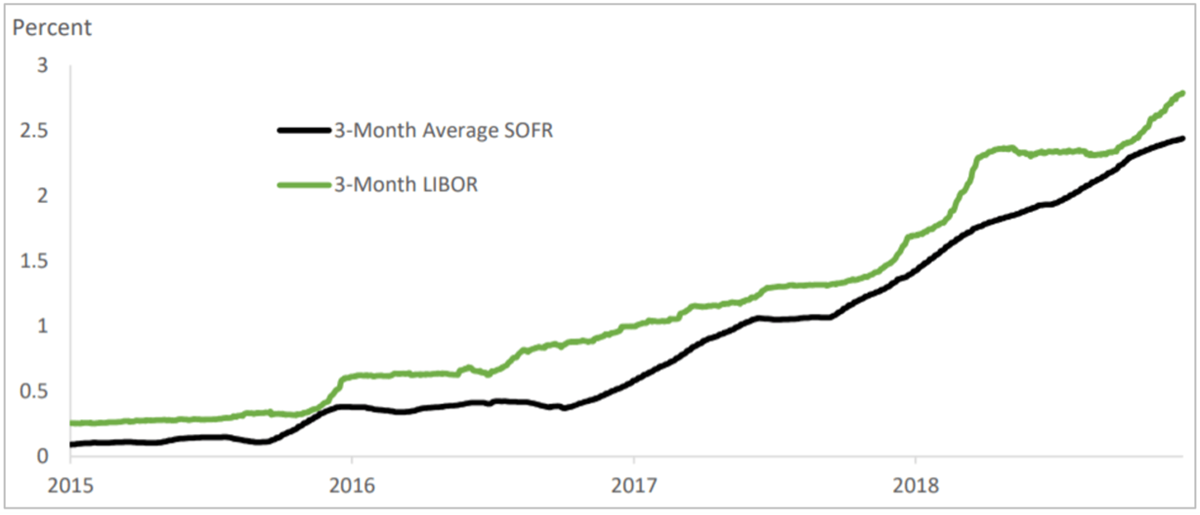

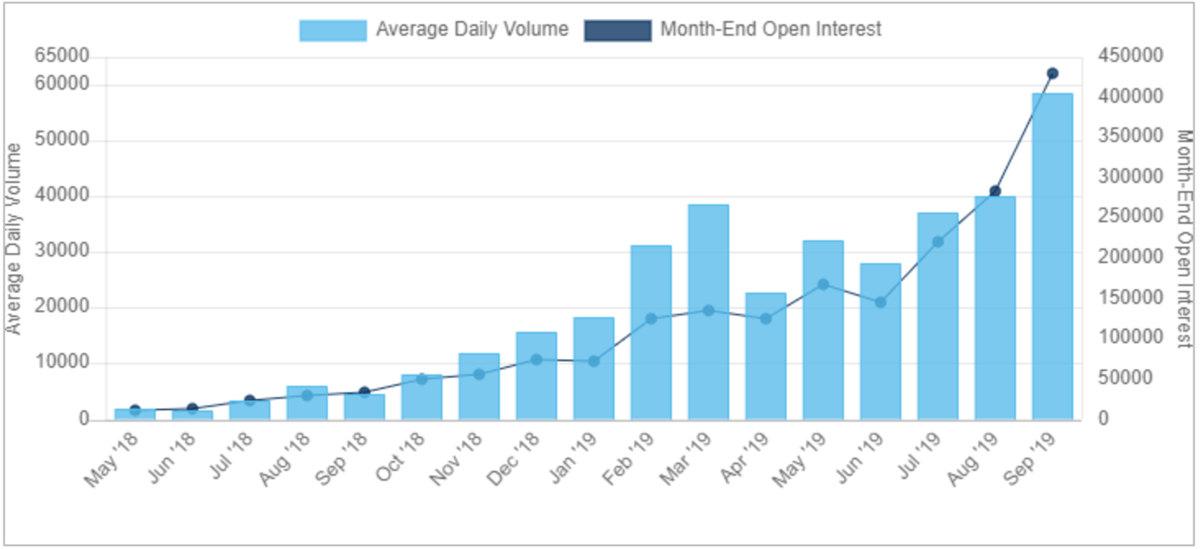

Many business owners and executives, however, may have yet to hear of SOFR, let alone understand how its introduction will affect the way they finance their businesses. In the long-term, the all-in cost of borrowing should see little to no change with the adoption of SOFR, relative to today’s broad use of LIBOR (see SOFR vs. LIBOR chart below), and, while SOFR is an overnight rate, derivatives markets that will serve as the foundation for forward-looking term rates are building liquidity (see CME SOFR Futures Volume chart below). So, while SOFR is an adequate reference for an overnight rate, there is not yet an adequate market in something akin to a 30-day, 60-day or 90-day SOFR rate, as it exists currently with LIBOR. The Fed does not anticipate that forward-looking SOFR term reference rates will be created until two years from now (in 4Q 2021).

In the near-term, borrowers should consider how they are positioned for the transition and evaluate what risks exist relative to existing borrowings if (or when) LIBOR is discontinued. It is critical that financial contracts that are being negotiated now have adequate fallback language addressing alternative base rates and alternative reference rates, and that borrowers are prepared to discuss the practical implications of such reference rate changes. In other words, if LIBOR becomes unavailable, what is my cost of borrowing? Given that borrower spreads using the alternative base rate are typically higher than those quoted using a LIBOR reference rate, the impact could be material. We regularly see an all-in rate differential between quoted alternative base rates and LIBOR rates of 50 to 100 basis points. The answer to this ‘what is my cost of borrowing’ question should be understood and anticipated, and fallback language must be written into future contracts in a way that protects against the risk of an excessive and unnecessary increase in interest expense. There are risks that the broad yield protection language that lenders draft into future contracts provides them the flexibility at the borrower’s expense.

For further reading… From the New York Fed and the Alternative Reference Rates Committee (ARRC):

Please let us know how we might be helpful to you with your corporate finance and capital raising needs.

SOFR VS. LIBOR

While SOFR tracks LIBOR rates, it is lower, suggesting that spreads over SOFR will differ from spreads over LIBOR for commercial borrowers.

Source: New York Fed

CME SOFR FUTURES VOLUME

While SOFR futures volume and open interest is growing, it is still a relatively small market.

Source: CME Group

Realizing Full Value

Corporate Fuel helps successful businesses address the challenges of growth.

Read our case studies