Strong M&A Market Despite Appearance of Some Economic Headwinds - Still a Good Time to Consider Selling a Business

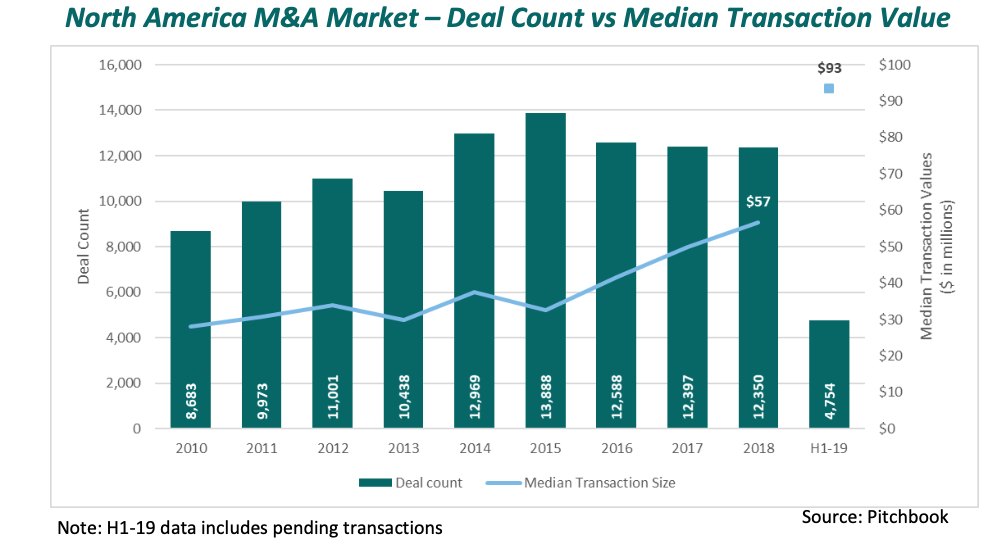

M&A activity in North America continues at a robust pace this year with $849 billion of closed transactions for 4,754 deals in the first half of 2019. The post-recession trend of strategic and private equity sponsored activity continues at a strong pace for large and small deals alike, as shown in the chart below. If currently announced deals close this year, M&A activity will again cross the $2 trillion threshold in 2019 for the fifth consecutive year. While total dollar volume is skewed by a number of mega mergers, such as United Technologies $90 billion acquisition of Raytheon, the median size of all transactions over the past 5 years is less than $100 million, an important consideration for middle market companies as they assess M&A market conditions for their business.

A number of recent indications suggest a mixed view that overall U.S economic growth may be slowing, yet a number of positive conditions remain:

- The outlook for third quarter earnings has shifted from a slight gain to a decline, particularly among multinational companies with most of their business outside the U.S.

- A weakening in a number of key sectors, notably housing, agriculture and retail, and the start of a slowdown in others such a trucks/transportation and industrial/business services.

- Geopolitical issues are challenging confidence, and global economic conditions are being impacted by the increase in tensions between China and Hong Kong and uncertainty whether the UK will finally leave the EU on Oct. 31. These macroeconomic trends largely impact larger multinational corporations.

- A continuation of the U.S.-Chinese trade war and prospects for further tariff increases have negatively affected CEO and consumer confidence and impacted future corporate profitability.

- The recent inversion of the yield curve for first time since 2005 has raised concerns about a recession. While an inverted yield curve can be a potential indicator of a downturn, on average it occurs 22 months before the beginning of a recession.

- Anticipation of future Fed rate cuts and other easing activities is lending to an emerging view that the US economy is slowing down.

- Expectation that capital availability will tighten, and interest rates will rise, dampening economic growth and, to a certain extent, M&A activity.

- On the positive side however, consumer confidence remains high as most notably evident in the recent July retail sales increase of 0.7% from a month earlier, and higher than the forecast of 0.3%.

- Gallup’s July U.S. Economic Confidence Index reached +29, up from +22 in June, with 54% saying the economy is getting better, up from 49% in June, and 53% describing the economy as excellent or good.

- The GDP forecast for 2019 is for 2.3%, with a range of 2-3% for 2020.

- Unemployment remains at record lows, with some expectation for continued modest wage growth of 3% or higher.

- Industrial production, which encompasses a wide variety of manufacturing industries, remains fundamentally robust, with production forecasted to grow to 3.9% in 2019, slowing to still strong 2.4% growth in 2020.

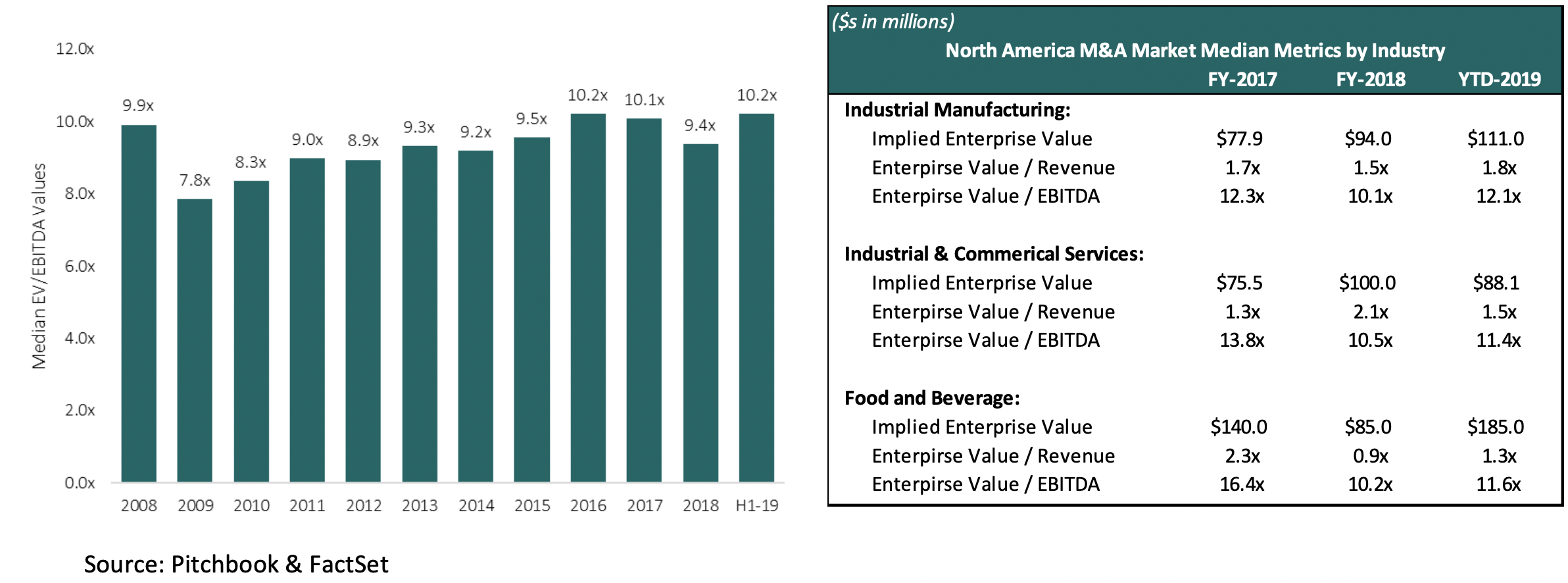

Against this backdrop, it is worth noting that the S&P Index is up 16% year to date, its best performance since 1997, but arguably buoyed by a continuation of the low interest rate environment. M&A multiples continue to remain high and, in some sectors, have risen over the past year, as shown in the chart below for the overall market and certain select industry sectors addressed by CF.

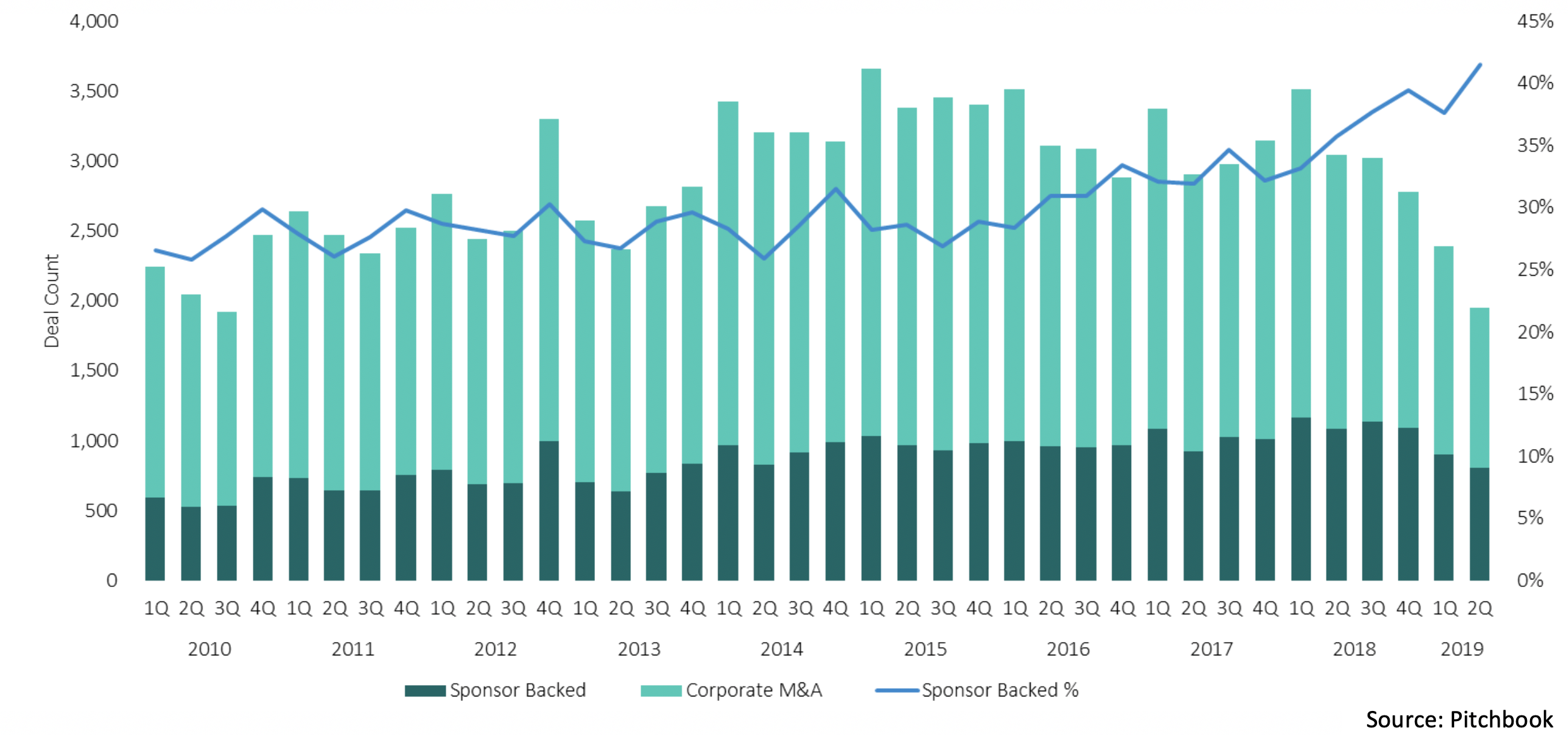

With access to low cost capital, corporates continue to aggressively pursue strategic external growth opportunities to strengthen their existing business, compete more effectively and profitability in the markets they serve, and better position themselves for the next economic downturn. Importantly, private equity continues to be a reliable and consistent acquirer of businesses across all sectors, and underpins the high strategic valuations being paid by corporates.

Historically, private equity has represented over 30% of the M&A market, measured by number of deals, but has grown to nearly 40% of all transactions thus far in 2019, as shown below. Uncommitted private equity funds stand at record levels, estimated to be over $2 trillion with over $700 billion raised in 2018 alone.

Corporate Fuel regularly performs in-depth evaluations for its corporate clients who are assessing whether now is an appropriate time to sell a business. Our reviews encompass an analysis of industry-specific market conditions, most likely potential acquirers, comprehensive assessment of key selling points and potential strategic and cost benefits for potential acquirers, the valuation range likely to be achieved and overall likelihood of success. Given somewhat mixed economic signals and market volatility, this type of initial assessment before any decision is made by a Board or business leader to sell their business may be more appropriate than ever to determine the probability of meeting objectives. As a result of this careful pre-transaction assessment, Corporate Fuel has a highly successful track record in selling businesses for its clients with favorable outcomes.

Realizing Full Value

Corporate Fuel helps successful businesses address the challenges of growth.

Read our case studies