Foodservice Faces Headwinds, Grocers Outperform

For food businesses, the coronavirus crisis has brought on challenges felt throughout the global economy and others unique to the industry. The circumstances affect operators across the food supply chain, from growers and importers, to grocers and restaurants. In a tumultuous few weeks since the S&P 500 reached its peak in February, financial markets across the globe have succumbed to the threat of continued economic disruption. An end to the 10+ years of (relatively) steady gains serves as a fresh reminder – or perhaps a rude awakening – that no bull market lasts indefinitely. The dual threat of a public health crisis and an economic slump poses challenges new to even the most seasoned executives, business owners, investors and politicians, and an already rapid news cycle has reached whole new velocity. As a result, stock markets have suffered daily losses and experienced volatility not seen since the 2008 financial crisis. The public health crisis has precipitated a global slowdown, and, while interrelated, the two events have unique potential to impact businesses and industries, whether positive, negative or a combination of the two. A closer look at stock market activity reveals a range of consequences for food industry subsectors, including the opportunities that exist.

The events of the past several weeks have been a boon to many supermarkets in the US. Food and grocery retailers have reported an uptick in sales, attributable in part to shoppers who are faced with the prospect of being stuck at home for an indefinite period of time and are in turn stockpiling home staples. On the flipside, foodservice establishments have experienced or are expecting varying degrees of reduced activity, as would-be diners steer clear of public spaces. Add a looming recession to the equation and these effects are amplified – if consumers have not tightened their grip on their wallets yet, financial markets suggest that they will.

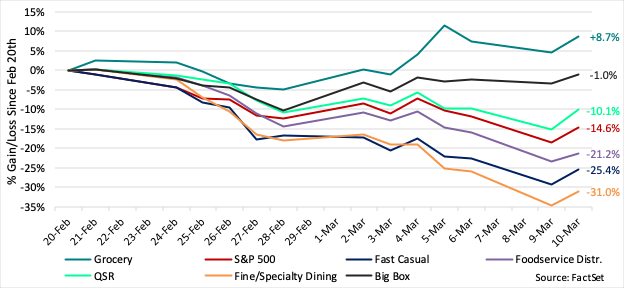

FOOD INDUSTRY STOCK PERFORMANCE VS. S&P 500

(FEB 20 - MAR 10, 2020)

The wide-ranging effects are borne out in the stock performance of public companies at the consumer-facing end of the food supply chain. Of the four grocery store companies included in the above chart (Kroger, Sprouts, Weis and Ingles), all have seen a net positive gain since February 20th (+8.7% in aggregate as of March 10th). The big box retailers (Walmart, Target and Costco) show mixed results, with an aggregate net loss of -1.0%, considerably better than the overall market. In the foodservice channel, results have been worse, particularly as one moves from the quick serve channel (-10.1%) to fast casual (-25.4%) to fine/specialty dining (-31.0%), with the bigger ticket dining establishments exhibiting a higher degree of cyclical risk. The distributors serving these businesses have experienced results somewhere in the middle (-21.2%), as they too are expected to feel the squeeze of downstream consumer demand tightening.

Market turmoil has not dissuaded Albertsons from moving forward with its public offering, perhaps encouraged by the positive public market trends exhibited by its industry peers. The supermarket giant filed for its IPO on March 6th.

What conclusions can small and medium-sized food businesses draw from these past several weeks? For one, the public markets can serve as a useful reminder of the importance of diversification and mitigating concentrations of risk within one’s own business. The US food industry has not been immune to the disruption in global trade resulting from coronavirus, underscoring the importance of diversity of supply and within sales and distribution channels. Also of importance, but less obvious as we look back at the first quarter, is the availability of liquidity during a period of economic uncertainty. We expect this to become more apparent in the near term, as the effects of supply shortages, softening demand and impaired customer creditworthiness give way to expanded working capital needs that tend to be more challenging to manage during times of business stress.

Please let us know how we might be helpful to you with your corporate finance and capital raising needs.

Peer group constituents:

- Grocery: KR, SFM, IMKTA, WMK

- Fast Casual: CMG, WING, SHAK, FRGI, LOCO, PBPB, HABT, NDLS

- Foodservice Distributors: SYY, USFD, CHEF, PFGC

- Quick Serve Restaurants: MCD, YUM, QSR, WEN, JACK

- Fine/Specialty Dining: CBRL, EAT, RUTH, STKS, DRI

- Big Box: COST, TGT, WMT

RECENT SPECIALTY FOOD, FOOD INGREDIENTS AND FOOD DISTRIBUTION ASSIGNMENTS

Realizing Full Value

Corporate Fuel helps successful businesses address the challenges of growth.

Read our case studies