Industrial Manufacturing M&A Activity Experiences Robust Recovery

May Be Time to Re-Evaluate Your Corporate M&A Strategy

2020 will forever be remembered as a year defined by COVID -19 and the unprecedented challenges presented to our healthcare systems, personal lives, business communities, and the global economy. Over a year later, with a vaccination process well underway, many sectors of the economy are still experiencing negative impacts related to COVID restrictions. Most notably, the restaurant, entertainment, travel, and hospitality industries still experience depressed levels of business, which have a “ripple” effect through many other sectors of the overall global economy. However, after an initial precipitous decline in March through May of last year, most sectors of the US industrial manufacturing and services industry have experienced a robust recovery and are now approaching pre-COVID levels of production and earnings. Correspondingly, industrial M&A activity has also recovered dramatically.

When governments instituted national and regional economic shutdowns beginning last March, most M&A activity was postponed or canceled amid the growing uncertainty around future economic conditions and business prospects. During this initial shock, many industrial companies temporarily closed operations or limited production to ensure the safety of employees. These closures were relatively short-lived, as governments generally deemed industrial companies as essential businesses. Notwithstanding labor, safety, and supply chain challenges, most companies reopened relatively quickly and were able to ramp up production in a measured but well-paced way throughout 2020.

As businesses gained additional clarity on the pandemic’s impact across industries and adjusted to the new market and operational dynamics, industrial production and earnings levels began to increase. For many of these companies, Q3 2020 represented a break-out period as companies became comfortable managing the COVID-era dynamics, and the economy across many sectors began to experience upturns.

Source: Pitchbook - Transactions above represent transactions by strategic financials buyers, but do not include any bankruptcy of distressed sales

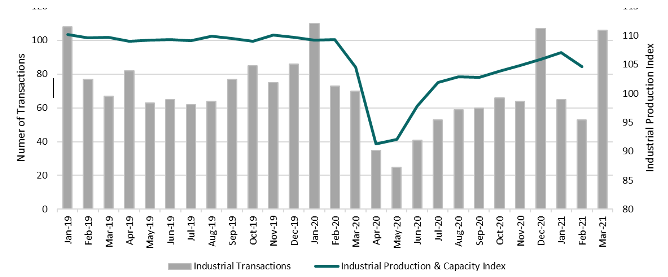

With improved market conditions and visibility on forward earnings, buyers and sellers began to reengage and pursue potential M&A transactions. The chart above illustrates the correlation between the ramp-up in industrial production and the increase in the number of completed industrial transactions, with both achieving a remarkable increase from the lows of last April and May.

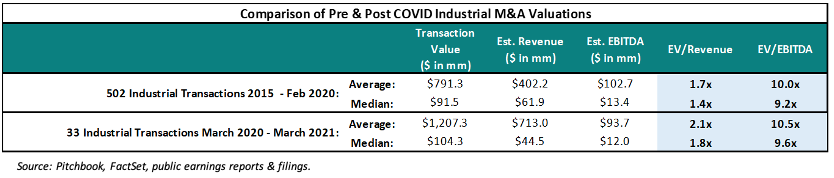

Initially, given the declines in revenue and profitability during Q2 2020 and the overriding uncertainty, many sellers were concerned that valuations would be depressed when they reengaged in the M&A market. Yet, in recent months, valuation multiples across the industrial sector have reflected historical levels, indicating corporate buyers’ renewed confidence and willingness to pay premiums for companies that meet their strategic objectives and provide higher levels of growth and profitability. Additionally, private equity firms have remained a constant source of underlying demand and foundational valuation support for industrial company acquisitions throughout this period. The chart below shows that recent industrial valuation multiples remained in line with multiples over the past six years.

RECENT HIGH PROFILE INDUSTRIAL TRANSACTIONS

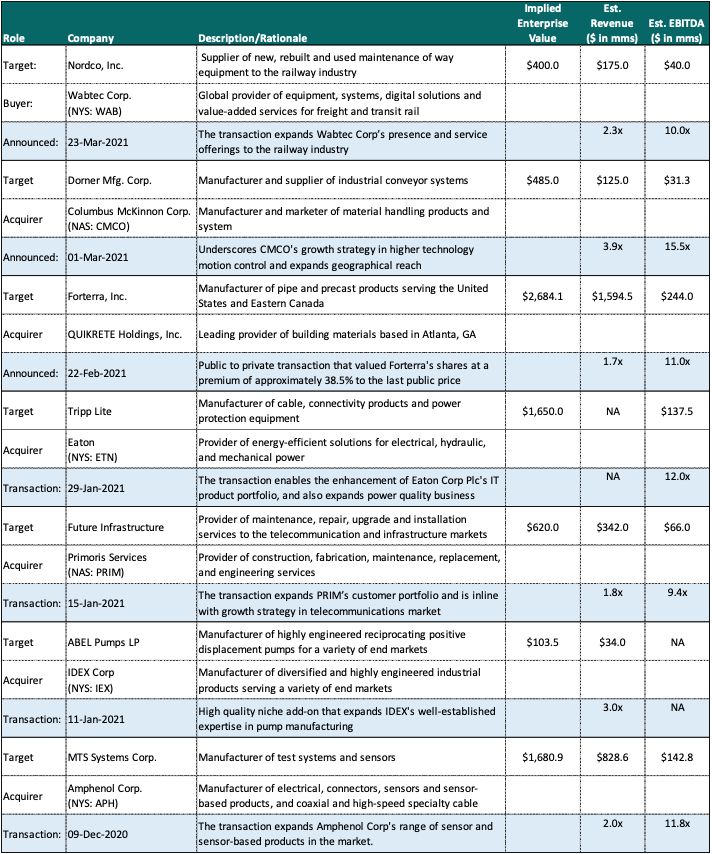

While not every sector in the industrial markets has fully recovered, interest in strategic acquisitions dramatically increased beginning in the 4th quarter of 2020. Renewed confidence that the vaccines will eventually mitigate the COVID health risk, expectations of a broad-based economic recovery, strong corporate balance sheets, and the continued availability of low-cost capital have driven a resurgence in industrial market M&A activity. Additionally, companies are now better able to forecast forward results, and the multiples paid for transactions over the last six months have approached pre-COVID levels. The following list shows examples of recent industrial transactions executed at premium values, which underscore these observations.

While we operate in an environment still impaired by COVID, the M&A market remains a viable option for business owners and boards to consider when evaluating current strategies to maximize their company’s enterprise value. For those who choose to pursue a sale of their company, defining and quantifying COVID-19’s impact on the business will be an integral part of the process. This exercise generally involves a strategic review of operations and the business’s financial condition, to present a normalized level of profitability and an unbiased evaluation of the business’s current and potential prospects. Corporate Fuel has extensive experience helping owners and boards evaluate their options, prepare businesses for a possible sale, and provide effective advice and assistance throughout the M&A process.

RECENT HIGH PROFILE INDUSTRIAL TRANSACTIONS

Realizing Full Value

Corporate Fuel helps successful businesses address the challenges of growth.

Read our case studies