Ingredients, Flavors & Fragrances

Focus of Innovation Highlighted by M&A Activity

Recent M&A activity has highlighted the strategic focus of innovation among top players in the Ingredients, Flavors & Fragrances sector. In anticipation of (or in reaction to) consumer trends, investment in organic growth initiatives as well as M&A strategies in this sector place an emphasis on:

- Healthy & Natural: addressing growing consumer demand;

- New Markets: exploiting local/regional niches and emerging markets; and

- Technologies: enhancing safety & freshness; nutritional value; and taste, texture & appearance.

In support of these initiatives, Ingredients, Flavors & Fragrances businesses augment their investment in Research & Development and Sales & Marketing with inorganic growth strategies, which play a particularly important role in the sector. With consumer tastes constantly evolving, being first to market is of paramount importance and value. When evaluating alternatives to enter an established customer or product segment, competitive dynamics can favor a “buy” strategy over a “build” strategy. Once a product is specified in a formulation, recipe or ingredient listing, it can result in consistent supply relationships and create high barriers to entry. This month’s announcement of International Flavors & Fragrances’ (NYSE:IFF) acquisition of Frutarom (TASE:FRUT) illustrates each of the 3 areas of focus above, as well as the competitive and market positioning rationale behind an M&A strategy. With the acquisition of Frutarom, IFF:

- Adds a portfolio of ingredients that includes natural colors, health ingredients and natural food protection (i.e. antioxidants);

- Diversifies its customer base – Frutarom’s 30,000 customers worldwide are largely comprised of local and regional customers; and

- Gains new technologies in biotech and enzymes.

The IFF-Frutarom transaction serves as a useful industry example, fitting well within the scope of IFF’s broader strategic plan to grow and diversify its business – a plan that is not entirely unique among IFF’s industry peers. Givaudan (SWX:GIVN) has placed a similar emphasis on high growth markets, health and well-being, consumer preferred products and integrated solutions. Givaudan’s recent acquisitions of Naturex (ENXTPA:NRX) and Centroflora’s Nutrition Division strengthen its natural product offerings and add to its presence in high growth markets in Latin America and Asia/Pacific.

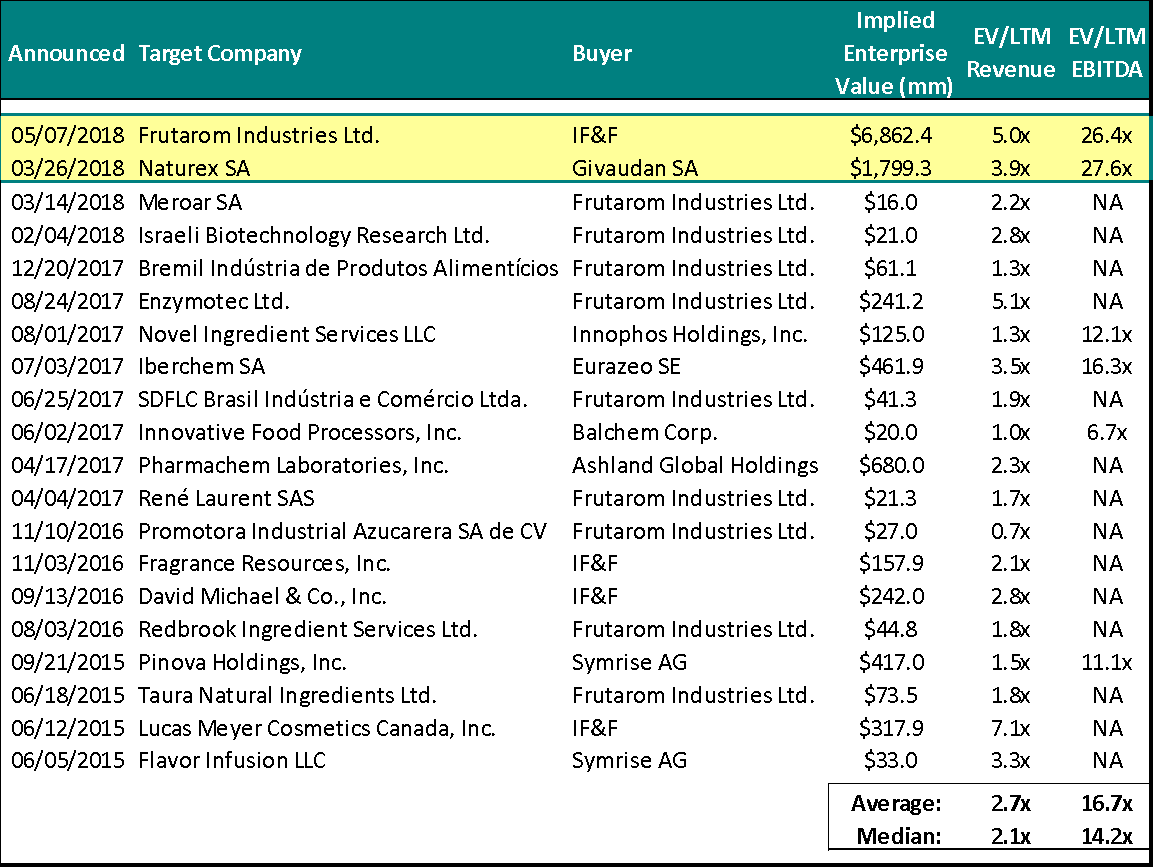

The value placed on these growing consumer segments – both end markets and product categories – is perhaps best evidenced by the Frutarom and Naturex acquisitions. At Enterprise Value (EV) to EBITDA multiples of 26.4x and 27.6x, respectively, these transactions represent the highest reported M&A valuation multiples in the Ingredients, Flavors & Fragrances sector in the last 3+ years… by a long shot. (As of this writing, IFF and Givaudan trade at EV/EBITDA multiples of 14.6x and 20.7x, respectively.) It may be difficult to imagine that paying such premium transaction values could be accretive to the acquirers’ earnings, at least in the near-term, and in IFF’s case, the Frutarom acquisition is not expected to be accretive until the second year. The investment rationale for both transactions reflects a longer-term view of value:

- The Healthy & Natural “megatrend” has been a catalyst for growth in consumer goods across several categories, from pet foods to toothpaste, and it shows no signs of slowing down;

- Ingredients, Flavors & Fragrances businesses have made cash cows of their activities in developed economies, but an ever-increasing level of globalization and access to New Markets offer an avenue to higher growth potential; and

- To maintain an edge over competitors and meet evolving consumer demands, these industry-leaders must keep pace with innovations in Technologies, especially relative to smaller, more nimble peers.

These trends represent a driving force behind IF&F and Givaudan’s strategies for growth and diversification, and a means of realizing full value for their shareholders.

Valuation Trends

M&A Transactions – Last 3 Years

Public Company Valuation Multiples – Last 10 Years

![Source: S&P Capital IQ [1] Includes: Givaudan, IF&F, Symrise, Sensient, Robertet [2] Includes: Kerry, Ingredion, Tate & Lyle, Darling, Balchem, Hawkins, MGP](https://corporatefuel.com/assets/news-events/news-flavors-2.png)

Select Corporate Fuel Assignments – Ingredients, Flavors & Fragrances

Realizing Full Value

Corporate Fuel helps successful businesses address the challenges of growth.

Read our case studies